OEMs in automation machinery manufacturing are outsourcing full machine builds to turnkey partners more than ever. Done right, you move faster and stay focused; done wrong, timelines slip, costs climb, and safety or uptime is at risk. This guide explains how to qualify that partner—evidence to demand, phase-gate cues for on-time FAT/SAT, how to gauge systems-engineering depth, and the commercial/IP terms that safeguard your roadmap—so outcomes stay predictable.

Why Supplier Qualification Matters in Automation Machinery Manufacturing

- Technical complexity: Small tolerance misses and control mismatches cause jams, scrap, unstable cycles—and failed FATs that push launches.

- Regulatory & safety: Certification gaps stall installs, trigger audits/rework, and damage credibility.

- Performance & uptime: Supplier slips become downtime, warranty exposure, missed SLAs, and higher TCO.

- Scale & lead time: If partners can’t ramp or absorb ECOs, deliveries bottleneck and trust erodes.

- Innovation & change: Partners who can’t adopt new sensors/controls/IoT leave you shipping yesterday’s machine—or paying for painful retrofits.

Key Steps to Qualify Suppliers

Use this framework to qualify automation machinery manufacturing suppliers:

| Step | What to Do | What to Look For / Questions to Ask |

|---|---|---|

| 1. Define your requirements clearly up front | Produce a supplier spec that includes all technical, quality, regulatory, delivery, cost, and lifecycle requirements. |

|

| 2. Pre‑screen potential suppliers | Use RFIs, supplier questionnaires, and site visits to screen out poor fits before deeper evaluation. |

|

| 3. Examine quality systems & certifications | Assess quality systems, process controls, and inspection capability. |

|

| 4. Assess engineering & design support | For automation machinery, suppliers must go beyond parts—they need to support DFM, prototyping, and hands-on problem solving. |

|

| 5. Capacity & lead times | Ensure supplier can handle your anticipated growth, variation, scaling from few to many units. |

|

| 6. Financial health & risk profile | Financial stability drives reliability (critical for SMBs/startups) |

|

| 7. Communication & program management | Many projects fail not technically, but because poor communication or misalignment of expectations. |

|

| 8. Cost structure & Total Cost of Ownership (TCO) | Evaluate total lifecycle cost, not just the quote. |

|

| 9. Audit & site inspection | Visit the facility or run a virtual audit. |

|

| 10. Pilot / trial run / qualification builds | Before full scale, run pilot builds and a witnessed FAT at the supplier. |

|

What Separates Great Suppliers from the Pack

Here are some more advanced/nuanced dimensions—often make or break in automation machinery manufacturing programs.

Vertical Integration & Subcontracting

Every handoff adds risk. Suppliers that keep more work in-house usually deliver faster iteration, tighter quality control, shorter lead times, and smoother coordination. However, full vertical integration isn’t always needed. What matters is transparency: if subcontractors are involved, know who they are, their capabilities, and how they affect overall project risk.

Surface / Finish / Material Specification

Automation machinery demands precise surfaces, finishes, and coatings—critical for sensors, seals, and moving parts. These details are often underspecified, so OEMs should spell out material grades, surface roughness, cleaning, pretreatments, and coatings. PEKO and similar suppliers can supply standard surface-finish specifications within their manufacturing processes.

Tolerance, Repeatability, Testing

Hitting tolerance once isn’t enough—the process must hold it consistently. Ask about measurement and test equipment, calibration schedules, and the use of SPC. For assemblies, require functional testing—covering alignment, vibration, and related checks—to verify stable, real-world performance.

Engineering & Innovation Partnership

The strongest supplier relationships are collaborative. Partners with deep engineering can propose cost/performance optimizations and guide prototyping, iteration, redesign, and manufacturability. For OEMs—especially SMBs and startups—this is a differentiator. PEKO, for example, works from functional specs or build-to-print and refines designs (DFM) across the lifecycle.

Certifications & Regulatory Compliance

Requirements vary by industry—medical, semiconductor, defense, energy—so align to ISO, safety, and environmental standards. Choose suppliers with the right certifications who can produce regulatory documentation. Don’t overlook export controls and material restrictions such as RoHS and conflict-mineral rules.

Risk Management & Redundancy

Ask how suppliers mitigate raw-material shortages, supply-chain disruptions, and tooling failures. Do they qualify second sources for critical parts and keep spare tooling or backup machines? Favor partners with contingency plans and alternate suppliers to protect schedule, quality, and cost.

Inside the Machine: What “Automation Depth” Really Means

Beyond the visible build, true automation performance depends on how well mechanical, electrical, and controls systems are integrated. In high-functioning machines, sensors, PLCs, and actuators operate in a synchronized loop—inputs and corrections happening in milliseconds. This isn’t achieved through bolt-on efforts late in the process; it requires unified system engineering from the start.

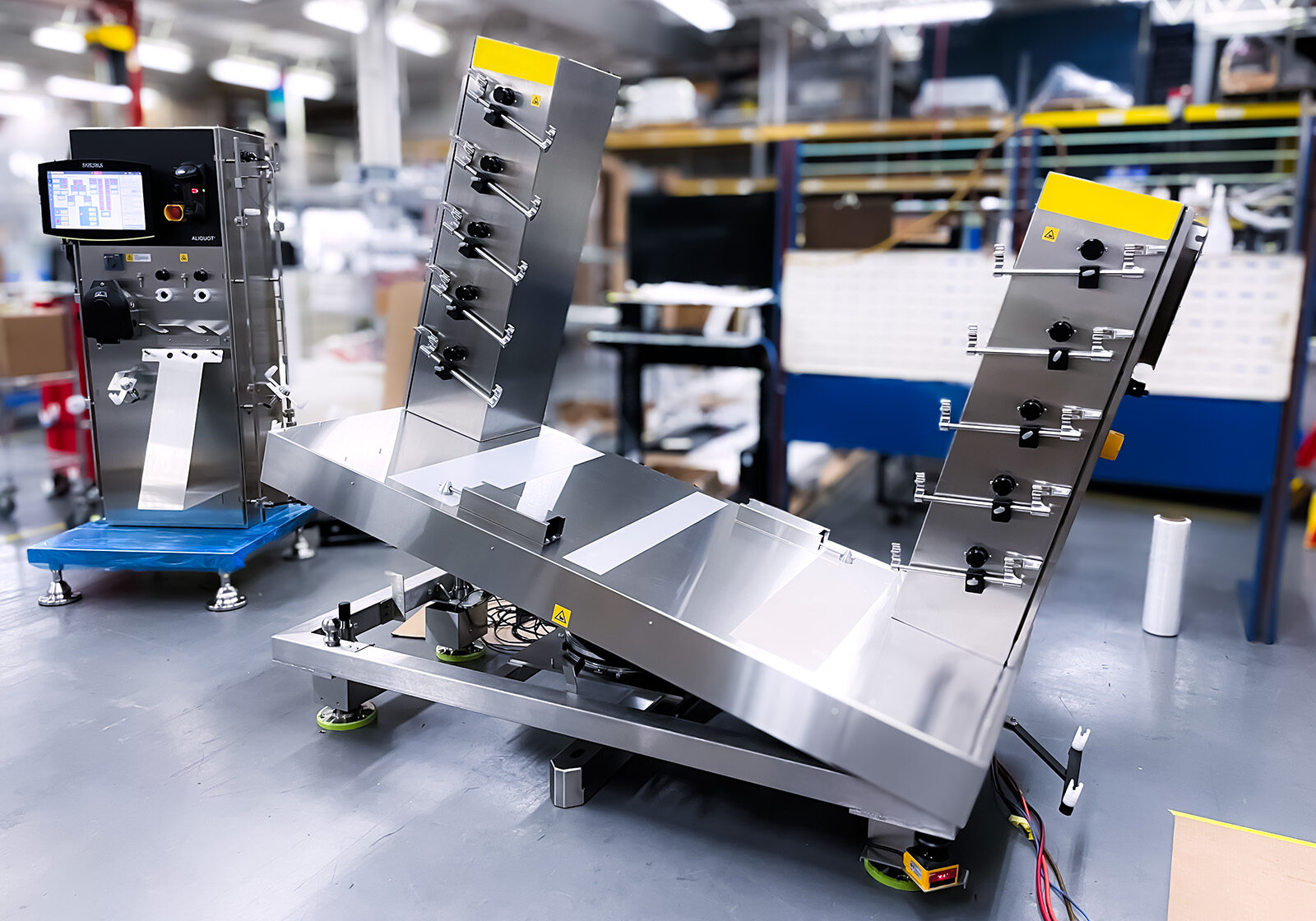

PEKO’s approach emphasizes this early coordination. Controls engineers collaborate with mechanical teams to size motors correctly, tune servo profiles to minimize vibration, and align pneumatics or hydraulics with multi-axis motion—all under a single PLC/HMI environment. Safety isn’t tacked on—it’s co-developed with motion logic, ensuring compliance is inherent.

This depth of integration stabilizes performance, reduces variation, and ensures the machine behaves predictably under real-world conditions. For OEMs, it’s what separates a basic assembler from a strategic manufacturing partner.

Ask who tunes the PID loops. Understand how motion and safety are co-engineered. Look for evidence of closed-loop testing. These are the markers of a partner equipped to deliver automation machinery manufacturing that performs—not just automation that powers on.

What Good Looks Like: PEKO Case Highlights

PEKO offers a useful benchmark for qualifying automation machinery manufacturing partners:

- End-to-end, in-house build: machining, sheet metal, welding, laser, cabling/panels, assembly, paint, test, and ship under one roof—fewer handoffs, one schedule owner, tighter quality loops.

- NPI & prototyping strength: refining designs early, running prototype/pilot builds with clear exit criteria, then scaling production to surface risks before they get expensive.

- Quality system discipline: BOM verification, GD&T/DFMA, calibrated inspection, test engineering, and lifecycle testing—capabilities you should require in qualification.

- Cross-industry credibility: complex programs in semiconductor, renewable energy, medical, and life sciences; ask for domain examples that match your regulatory/tolerance demands.

Let this be the baseline; require proof in writing and on the floor before awarding the program.

Common Pitfalls & How to Avoid Them

Even with a good process, OEMs often make mistakes. Here are common pitfalls with suggestions:

| Pitfall | Why It Happens | What to Do Instead |

|---|---|---|

| Underspecifying critical attributes | Assuming “standard finish / tolerance / material” are good enough; moving forward without clarifying | Write detailed specs, surface finish, tolerance, material; use drawings, define testable metrics; get supplier sign‑off on specs |

| Overlooking sub‑supplier & chain risk | Supplier has subcontractors, but you don’t audit or know them; chain breaks or quality gaps | Ask for the supplier’s supply chain, do audits or require documentation of critical sub‑suppliers; demand traceability |

| Choosing by lowest cost only | Price is visible; long term costs, defects, delays are not; OEM underestimates hidden costs | Use TCO; pilot events; include warranty / rework / downtime in cost modeling |

| Not doing pilot / prototype builds before scaling | Assumes what works on paper or in small sample will scale | Make pilot builds mandatory; define exit criteria before mass production |

| Ignoring communication & cultural fit | Supplier may be technically sound, but slow to respond or misaligned in priorities | Try small projects first to test responsiveness; check project management practices; clarify escalation paths early |

| Overlooking regulatory / environmental compliance | New markets, changing standards require compliance; catch later is costly | Request certifications; ask for regulatory experience; ensure supplier is aware of your industry’s safety & regulatory landscape |

Practical Supplier Qualification Checklist for Automation Machinery Manufacturing

Here’s a practical checklist you can use (or turn into an internal supplier‑qualification form) when evaluating a supplier.

- Basic Info & Capabilities

- Years in business, customer references in similar industry

- Physical location, facility size, number of employees

- Precision machining, welding, sheet metal, controls, electrical, automation experience

- Engineering & Design Support

- In‑house engineering (mechanical, electrical, controls, test)

- DFM / design reviews, etc.

- Prototyping / pilot build capability

- Quality System

- Certifications (ISO, etc.)

- Inspection, measurement, SPC, calibration systems

- Material traceability, documentation, data capability

- Process Capabilities

- Machinery types, capacity, tolerances (microns etc.), finishes

- Surface treatments, coatings; environmental control if required

- Supply Chain & Sub‑Supplier Management

- Sources for critical materials/components, backup suppliers

- Lead times, risk mitigation strategies

- Cost & Pricing Transparency

- How quotes are built: what’s included / excluded

- Setup / NRE costs, tooling, fixtures, testing, shipping

- Capacity & Scalability

- Existing load, ability to ramp up/down

- Redundancy, spare capacity, ability to handle change orders

- Delivery & Logistics

- On‑time delivery rates, logistics capability

- Geographic location, shipping practices, packaging

- Testing & Validation

- Prototype / pilot phase test protocols

- Environmental, durability, safety tests

- Regulatory / Compliance

- Certifications, safety standards relevant to your market

- Material standards, environmental / hazardous substances compliance

- Communication & Project Management

- Tools, status reporting, escalation paths

- Contract clarity (expectations, ownership of defects, change orders)

- Financial & Risk Assessment

- Financial stability, capacity to invest in your program

- Insurance, indemnity, risk sharing

How to Use Qualification Findings

It’s not enough to collect data—you need to use it to make decisions. Here’s how:

- Score / rank suppliers: turn your checklist items into weighted criteria (quality, cost, delivery, support, etc.). Assign scores.

- Run pilot projects: Before committing to high volume or long‑term, pick top suppliers and run pilot builds or smaller contracts to validate.

- Set up supplier contracts wisely: include clear specifications, warranty / quality clauses, penalties for non‑compliance, performance KPIs.

- Monitor performance: after qualification, maintain supplier scorecards. Track metrics: quality (defects, returns), on‑time delivery, responsiveness, cost variances.

- Continuous improvement: partner with suppliers to refine processes; when issues arise (lateness, quality drift), trigger corrective actions early.

High-Impact Priorities When Resources Are Tight

When time and budget are tight—prioritize these for maximum impact:

- Focus on early stage risks: run prototypes & pilots to expose weak links before scale.

- Choose capability over price: strong engineering beats cheap quotes that lead to rework and delays.

- Go local when it helps: shorter logistics, easier audits, and faster turns—balance with capability and cost.

- Qualify in phases: start with core mechanicals; add subassemblies etc. as confidence grows.

- Specify what matters: set tight tolerances/safety for critical features; relax noncritical attributes to control cost.

Qualifying suppliers for automation machinery manufacturing is a strategic lever for quality, cost, reliability, and scale. The right partner means smooth production, satisfied customers, and profitable growth; the wrong one invites defects, delays, and firefighting. Define clear requirements, use checklists, run pilot builds and FAT/SAT, and verify engineering, quality, and process depth. Then monitor with scorecards to sustain performance.

PEKO’s track record—vertical integration, strong engineering, prototyping, rigorous quality, and thorough testing—offers a strong benchmark for supplier excellence. Wondering if PEKO can build your machine? Let’s talk fit: